Overview

Welcome

Now in the ninth year, we would like to offer a warm welcome to the 9th Annual Family Wealth Report Awards 2022.

Award Categories

The Family Wealth Report Awards categories are focused around three main areas:

- Experts (individuals and teams)

- Products

- Services for wealth managers and clients/institutions of all sizes and types

A full list of this year’s updated Categories is available to download, and you are now able to Register your interest in submitting.

Judging Process

As always, independence, integrity and genuine insight are the watchwords of the judging process.

There are more than forty judges coming from family offices, private banks, trusted advisers, consultants and other service providers each of whom has in-depth knowledge and a broad experience.

The deadline for us to receive your submissions is 15 October 2021, when the judging process begins.

Every submission is carefully reviewed to ensure the most deserving companies and individuals are selected as winners in each category. Standout submissions that are close runners-up to the winning entry are often commended by the judges.

Commercially sensitive information is kept confidential and conflicts of interest are avoided at all times.

Awards Notification Process and Marketing Your Success

Winning a Family Wealth Report Award sets organizations and individuals apart from their peers and is a tangible demonstration that they have something special to offer. It rewards achievement and showcases top-class performance, innovation and distinction.

They are also tangible demonstrations of the sustainability and robustness of your organization. Winners, commended companies and finalists will be given advance notification for their success, allowing time to prepare their marketing messaging around the promotion of their achievement before the public announcement in 2022.

Family Wealth Report – as the leading voice of the family office community – will work with the winners to optimize their success by offering a range of marketing collateral.

Classification

Finalist – Firms and individuals who reach the last stage of the Family Wealth Report judging process and form the shortlist from which a category winner is selected. The finalists will be listed on the Finalist tab of the awards website and published in Family Wealth Report‘s social media channels.

Winner – Firms and individuals who have been selected category winner by the Family Wealth Report judges. The winners will be listed on the Winner tab of the awards website and published in Family Wealth Report‘s editorial and social media channels.

Commended – Firms and individuals that the Family Wealth Report judges recognize for an exceptional product, solution, service or other offering in the family office and wealth management industry in North America.

Tickets and marketing items and benefits

The judging process is completely independent of the commercial arrangements between the participants and the organisers. Finalists per grouping will be announced in the coming months. Winners and commended firms and individuals will not know their status ahead of the public announcement on 4 May. Finalists receive their finalist logos and other benefits when ordering tickets for the Gala Dinner on 4 May at the Mandarin Oriental hotel in Manhattan, New York.

The ceremony is a celebration of industry successes, a great moment to network and meet each other in person. At the ceremony, we will announce the finalists per category, and all winners and commended firms and individuals.

Contact Points

For questions, please contact theodora.viney@clearviewpublishing.com

Key Dates

Key dates for the diary

- Nominations open: June 21, 2021

- Nominations close: October 15, 2021

- Finalist notification: From January 17, 2022

- Public announcement of Winners and Commended firms and individuals at the awards ceremony: May 4, 2022

- Public announcement of Winners and Commended firms and individuals in Family Wealth Report editorial and social media channels: from May 5, 2022

Judges

Judging Panel

Amanda Anderson

Chief Administrative Officer

Ascent Private Capital Management of U.S. Bank

With more than 20 years’ experience in the financial sector, Amanda manages products and services tailored to the needs of ultra-high net worth families. She has responsibility for operational support […]

With more than 20 years’ experience in the financial sector, Amanda manages products and services tailored to the needs of ultra-high net worth families. She has responsibility for operational support and delivery, regional and national coordination, and management reporting. Her role further includes matrix supervision of all managing directors of client experience and specialized fiduciary services with the goal of achieving exemplary execution on behalf of Ascent’s clients. Amanda’s favorite quote from the writer and poet Maya Angelou informs her approach to client service: “People will forget what you said, people will forget what you did, but people will never forget how you made them feel.” Her aim is “to create an environment where clients are delighted and feel valued.”

Amy Hart Clyne

Chief Knowledge & Learning Officer

Pitcairn

Amy Hart Clyne has dedicated her career to helping prosperous families fulfil the promise and potential of their legacies and achieve wealth momentum. As Chief Knowledge and Learning Officer, Amy […]

Amy Hart Clyne has dedicated her career to helping prosperous families fulfil the promise and potential of their legacies and achieve wealth momentum. As Chief Knowledge and Learning Officer, Amy brings more than 25 years of experience in the ultra-wealth space. Located in Pitcairn's New York office, her primary focus is to expand the firm’s position as the leader in family learning by building out its proprietary Wealth MomentumÒ family office model. As part of this effort, she is responsible for the creation and development of the Pitcairn Center for Family Legacy—the company’s industry think tank intended to provide unique resources, thought leadership, and educational tools to families in transition.

Anna Garcia

General Partner

Runway Venture Partners

Anna Garcia is Co-Founder and Partner at Runway Venture Partners, a New York-based early stage VC firm focused on investing in post product-market fit B2B SaaS companies. Prior to entering venture capital, Anna spent 17 years in financial […]

Anna Garcia is Co-Founder and Partner at Runway Venture Partners, a New York-based early stage VC firm focused on investing in post product-market fit B2B SaaS companies. Prior to entering venture capital, Anna

April Rudin

Founder and President

The Rudin Group

The Rudin Group founder April Rudin is a widely acknowledged top marketing strategist for the financial-services and wealth-management sectors. Her firm designs bespoke marketing campaigns for leading wealth-management firms, fintechs, […]

The Rudin Group founder April Rudin is a widely acknowledged top marketing strategist for the financial-services and wealth-management sectors. Her firm designs bespoke marketing campaigns for leading wealth-management firms, fintechs, and family offices; campaigns that strengthen brand value and drive client acquisition. Recognized as an IBM “influencer,” she is a regularly-featured source of expertise, contributes to Capgemini’s World Wealth Report, produces the CFA Institute’s annual U.S. outlook, and often speaks about wealth, next-gen, and fintech. She’s been published extensively and judges the Family Wealth Report’s annual Wealth Management Industry Awards and is a member of their advisory board. Her two sons say she has always been an “influencer”.

Bill Woodson

Advisor

Various

Bill has spent his career advising founders, wealth creators, closely held business owners, and family offices across a wide range of wealth management disciplines, including investment management, taxation, estate planning, […]

Bill has spent his career advising founders, wealth creators, closely held business owners, and family offices across a wide range of wealth management disciplines, including investment management, taxation, estate planning, philanthropy, and wealth education. He joined SVB from Citigroup, where he was a managing director and head of the Family Office Group for Citi Private Bank. Before joining Citigroup, Bill was a managing director and head of the Ultra-High-Net-Worth (UHNW) and Family Office business for Credit Suisse.

Bill began his career in “Big Four” public accounting, where he spent a decade providing tax and related planning advice to clients. He left public accounting to run the family office of one of his clients, a Hong Kong–based family with 40 employees and operations in Hong Kong, San Francisco, and Vancouver. Bill was also a founding member of myCFO, an integrated wealth management and technology firm started by several well-known Silicon Valley entrepreneurs. Shortly before the sale of myCFO to Harris Bank, Bill joined Merrill Lynch’s Private Banking and Investment Group and oversaw an integrated investment advisory practice for UHNW families and family offices ranging in net worth from $25 million to $2 billion. Bill earned a master’s degree in accounting from New York University’s Leonard N. Stern School of Business and a bachelor’s degree in economics from University of California, Irvine.

A frequent author on wealthy families’ issues, Bill co-wrote “The Family Office: A Comprehensive Guide for Advisers, Practitioners, and Students,” published by Columbia University Press. He’s been quoted extensively in financial publications and was named one of Family Capital’s 100 Influencers – Consultants. In addition, he’s a lecturer in the Master’s in Wealth Management program at Columbia University School of Professional Studies, the chair of the advisory board for the Stanford University Global Family Office Initiative, and a co-founder of the UHNW Institute, an independent nonprofit that provides thought leadership and content helpful to families, family offices, and professionals.

Bob Oros

Chairman & CEO

Hightower

Bob Oros is Chairman and CEO of Hightower, a national wealth management firm that invests in and empowers financial advisory businesses to drive growth and help clients achieve ‘well-th. rebalanced.’ […]

Bob Oros is Chairman and CEO of Hightower, a national wealth management firm that invests in and empowers financial advisory businesses to drive growth and help clients achieve ‘well-th. rebalanced.’ Under Bob’s leadership, Hightower has accelerated acquisitions, expanded services for advisors and achieved consistently strong organic growth. He has over 25 years of strategic and operational experience, with a track record of successfully recruiting, retaining and supporting advisors. He previously served as CEO at HD Vest, EVP and Head of the RIA Segment at Fidelity Clearing and Custody, and held various leadership roles at LPL Financial and Charles Schwab.

Bruce Weatherill

Chief Executive

Weatherill Consulting

Bruce is a chartered accountant with over 37 years financial services experience, previously a partner in PwC, latterly as Global leader of their Wealth Management practice and the key driver […]

Bruce is a chartered accountant with over 37 years financial services experience, previously a partner in PwC, latterly as Global leader of their Wealth Management practice and the key driver of their bi-annual Wealth Management Report. Bruce is now CEO of Weatherill Consulting providing advice on client centricity and wider strategic matters to wealth managers. He is the author of The Value of Trust: the quest by Wealth Managers for Trusted Advisor status and a number of other thought leadership reports. Bruce is chairman of ClearView Financial Media and a non-executive of a number of companies including Fidelity Holdings UK, The Wisdom Council, ComPeer, JDX Consulting and Ten Group.

Buzz Bray

Principal

Bray Executive Search

Buzz Bray founded RMG Associates in 2005, and transitioned to Bray Executive Search in 2019. Buzz is one of the leading recruiters in the family wealth industry, focusing on wealth […]

Buzz Bray founded RMG Associates in 2005, and transitioned to Bray Executive Search in 2019. Buzz is one of the leading recruiters in the family wealth industry, focusing on wealth management serving families with significant multi-generational wealth. His recruiting network includes family offices as well as ultra-affluent wealth advisory, and he has had the privilege of being a trusted consultant with leading industry talent in their career considerations and transitions. Buzz has working knowledge and relationships with executive leadership of many leading firms, and has consistently been a productive resource in connecting top talent with opportunity.

Carol R. Kaufman

Founder and CEO

Pinventory

Carol R. Kaufman consults to HNW families, entrepreneurs and trusted advisors. Her newly released software venture, Pinventory®, coupled with her consulting service, www.homeinventoryacademy.com, focus on the responding to the need for […]

Carol R. Kaufman consults to HNW families, entrepreneurs and trusted advisors. Her newly released software venture, Pinventory®, coupled with her consulting service, www.homeinventoryacademy.com, focus on the responding to the need for home inventories, ensuring that important possessions and their supporting information are properly catalogued, securely shareable and easily accessible, anywhere and anytime that information is needed. Her first software product, InvesTier®, was acquired by SunGard in 2002. An entrepreneur for over 35 years, Ms. Kaufman’s specialties include public speaking, training and software/service-based solutions to organizational problems. She resides in Hawthorne, NJ and Otis, MA.

Carole Crawford

Managing Director, Americas Region

CFA Institute

Carole has more than 25 years of leadership experience in finance, investment management and business development. She’s a forward looking, trusted advisor and advocate with a strong focus on growth, […]

Carole has more than 25 years of leadership experience in finance, investment management and business development. She's a forward looking, trusted advisor and advocate with a strong focus on growth, innovation, transformation and building productive strategic alliances. Her foundation of the CFA charter combined with professional experience as a public and private markets investor and tech CFO enables robust analysis and sharp decision making. She focuses on realigning family office structures and integrated asset management, including direct and co-investment in venture. She is a Fintech Expert, actively engaged in its complex innovation ecosystem of startups, investors, incumbent banks and investment firms, consultants, advisors and regulators, identifying industry trends and relevant opportunities.

Catherine McCormick

Tax Manager

Pisces Inc

Catherine has over 11 years of experience assisting high net-worth individuals minimize their income and estate tax exposures. Catherine started her career in the UK with the accounting firm BDO […]

Catherine has over 11 years of experience assisting high net-worth individuals minimize their income and estate tax exposures. Catherine started her career in the UK with the accounting firm BDO LLP, before moving to the San Francisco office as part of an expansion. Catherine has a unique insight into both UK and US tax systems and her clients have included entrepreneurs, chief executives, and individuals with complex international aspects to their affairs. In 2019 Catherine joined a private family office as the trust and estate tax specialist, providing ongoing tax advice and coordinating all trust and estate tax filings. Here, Catherine is part of the core team implementing the upgrade of technology systems, including CRM, document management, and General Ledger systems. Catherine was voted Top 35 Under the age of 35 in the Private Wealth industry in 2016.

Charles Lowenhaupt

Managing Member

Lowenhaupt & Chasnoff

Charles A. Lowenhaupt is a recognized leader in managing wealth for ultra-high net worth families. He is also Chairman and CEO of Lowenhaupt Global Advisors. Charles has a Bachelor of […]

Charles A. Lowenhaupt is a recognized leader in managing wealth for ultra-high net worth families. He is also Chairman and CEO of Lowenhaupt Global Advisors. Charles has a Bachelor of Arts degree (cum laude) from Harvard University. He also has a Juris Doctorate (Order of the Coif) from the University of Michigan Law School. He is a member of the Bar of New York and Missouri. Charles is the author of The Wise Inheritor’s Guide To Freedom From Wealth, published in 2018. He is also co-author of Freedom From Wealth with Don Trone, published in 2011.

Dennis Mangalindan

Vice President

SEI

Dennis is responsible for developing strategies to help SEI Family Office Services reach new markets, attract new leads and acquire new clients. In this role, he leads speaking engagements at […]

Dennis is responsible for developing strategies to help SEI Family Office Services reach new markets, attract new leads and acquire new clients. In this role, he leads speaking engagements at industry events and manages the sales cycle. With a core focus on family offices, accounting firms and other wealth management organizations selecting a technology solution, Dennis has worked with many of the Forbes 185 families and Forbes 400 individuals for over 17 years. Prior to joining SEI, Dennis served as Managing Director of Sales and Marketing at Financial Navigator, Inc.. Dennis holds a Bachelor of Science in Business Administration with a concentration in Marketing from San Jose State University.

The Ninth Annual Family Wealth Report Awards 2022

Tania Neild

CEO

InfoGrate

Dr Neild is CEO of InfoGrate, a consulting boutique specializing in information technology for family offices. We architect solutions that encompass GL/portfolio management/partnership accounting/CRM selection, data integration, operations, performance reporting, […]

Dr Neild is CEO of InfoGrate, a consulting boutique specializing in information technology for family offices. We architect solutions that encompass GL/portfolio management/partnership accounting/CRM selection, data integration, operations, performance reporting, and infrastructure/ cloud management. Tania has over 25 years of academic and applied research in data integration. She began her career with the National Security Agency, which awarded her the National Physical Sciences Consortium Award to fund her research in heterogeneous database integration. She earned a PhD in computer engineering from Northwestern University and a Bachelor’s degree in mathematics and computer sciences from Emory University.

Gemma Leddy

Partner-in-Charge, PKF O’Connor Davies Family Office

PKF O’Connor Davies Family Office

Gemma Leddy, CPA is the founder and Partner-in-Charge of the award-winning PKF O’Connor Davies Family Office practice. She is also managing director of PKF Funds and Family Office, headquartered in […]

Gemma Leddy, CPA is the founder and Partner-in-Charge of the award-winning PKF O’Connor Davies Family Office practice. She is also managing director of PKF Funds and Family Office, headquartered in London. Gemma has spent over 30 years working with high profile and ultra-high-net-worth individuals, multi-generational families and family offices. Gemma and her team provide comprehensive financial management and CFO services, accounting and reporting, family investment administration services, tax planning and compliance, lifestyle and transactional support and family advisory services. Before joining the firm, Gemma was the Chief Financial Officer of a private family office and investment firm and a Partner in a New York City CPA firm and led their Family Office and Business Management Division.

Gregory F. Roll

Co-Founder

Touchpoint

Gregory is a passionate brand strategist who believes that in a crowded, seemingly commoditized investment and wealth management marketplace, there is great need for innovation; that the ever-increasing sophistication of […]

Gregory is a passionate brand strategist who believes that in a crowded, seemingly commoditized investment and wealth management marketplace, there is great need for innovation; that the ever-increasing sophistication of the ultra-high-net-worth, their ever-expanding needs, and the ever-changing investment environment demand this. He is dedicated to creating and evolving the strategies, tactics, and implementations of those who seek to achieve a business imperative: differentiation in pursuit of deliberate and sustained growth. Across a career spanning more than two decades serving those who serve the UHNW, Gregory remains an optimistic agent of change, evangelist of “Show, don’t tell” and believer in magic.

Ida Liu

Head of Citi Private Bank, North America

Citi Private Bank

Ida Liu is the head of Citi Private Bank, North America and a member of the Private Bank Global Leadership Team. In this role, Ida is directly responsible for delivering […]

Ida Liu is the head of Citi Private Bank, North America and a member of the Private Bank Global Leadership Team. In this role, Ida is directly responsible for delivering the Private Bank offering to our key client segments and leads 25 offices across the United States and Canada.

Ida is a World Economic Forum Young Global Leader, member of Committee of 100, member of YPO and has received numerous accolades including 2020 Barron’s Top 100 Most Influential Women in Finance, Crain’s Forty Under Forty and is a frequent speaker and commentator on Bloomberg, WSJ, MSNBC, Reuters and others. She is a former Board Member of Wellesley College Alumnae Association, Harvard Kennedy School Women’s Leadership Group and Volunteers of America.

James H McLaughlin

Founder and CEO

J H McLaughlin & Co

James “Jamie” McLaughlin founded J. H. McLaughlin & Co., LLC, a management consulting firm focused on strategy and practice management for wealth management and investment advisory firms, private banks, trust […]

James “Jamie” McLaughlin founded J. H. McLaughlin & Co., LLC, a management consulting firm focused on strategy and practice management for wealth management and investment advisory firms, private banks, trust companies, single and multi-family offices, in 2010. He is a co-founder of The UHNW Institute, an independent “think tank” directed at the needs of ultra-high-net-worth families and their advisors. Previously, he was CEO of Geller Family Office Services, a partner at Convergent Wealth Advisors, the regional president of Mellon Private Wealth Management’s New York region, and a financial advisor at Sanford C. Bernstein & Co., Inc.

Joe Calabrese

COO Wealth Management

Key Private Bank

Joe Calabrese is Chief Operating Officer at Key Wealth Management. He is responsible for overseeing the development, integrated delivery, and strategic development of a full range of financial planning, investment, […]

Joe Calabrese is Chief Operating Officer at Key Wealth Management. He is responsible for overseeing the development, integrated delivery, and strategic development of a full range of financial planning, investment, fiduciary and banking capabilities for Key’s clients. He joined Key in 2016, and lends his knowledge and expertise to affluent individuals, families, business owners, and institutions. Before joining Key, Joe held a wide range of executive roles including President and CEO of Geller Family Office Services, and President of Harris myCFO, which focused on serving clients with a net worth in excess of $100 million. Joe graduated from McGill University with a joint honors degree in Economics and Finance and holds a Chartered Accountant designation. Joe actively serves on the advisory board of The UHNW Institute and the Gaples Institute for Integrative Cardiology.

Jon Carroll

Managing Director, Private Client Services, Family Office Advisory

EY

Jon Carroll is an managing director in the Ernst & Young US Americas Family Office Advisory practice. His primary focus is advising family members, family business owners, trustees, and family […]

Jon Carroll is an managing director in the Ernst & Young US Americas Family Office Advisory practice. His primary focus is advising family members, family business owners, trustees, and family office executives on how to grow and govern their single-family office. Jon has extensive experience advising families on the set-up and structure of their family office, strategic planning and implementation, leading practices, business and operational risk assess¬ment, and family office systems and technology search, selection, implementation and integration. Jon has over 26 years experience serving UHNW families, including seven years working in a family office as chief operating officer. Before joining Ernst & Young, Jon was president and CEO of Family Office Metrics.

Jonathan North

Head of Products

4Pines Fund Services

Jonathan North, Head of Products for 4Pines Fund Services, has spent the past 20 years working with technology firms and family offices. Jon began his work with family offices at […]

Jonathan North, Head of Products for 4Pines Fund Services, has spent the past 20 years working with technology firms and family offices. Jon began his work with family offices at Financial Navigator where he learned about the market and software. He joined FundCount as one of the initial employees. He helped FundCount emerge as a software competitor in the US market while helping to expand it from a hedge fund product into a family office offering. More recently, Jon led the sales and marketing efforts for the Private Client business at SS&C and took over as Head of Private Clients North America for Alter Domus. With his current venture away from family office market it was a perfect time for Jon to lend his perspective to the FWR team.

Joseph W Reilly Jr

CEO and Founder

Circulus Group

Mr. Reilly is an investment and strategy consultant to family offices and the host of the Private Capital Podcast. He was the co-founder and founding president of the Family Office […]

Mr. Reilly is an investment and strategy consultant to family offices and the host of the Private Capital Podcast. He was the co-founder and founding president of the Family Office Association, a global forum for single-family offices that is based in Greenwich, Connecticut. Previously Mr. Reilly helped to start a single-family office and foundation in New York where he was an investment manager for five years. He was an energy specialist focused on options and futures trading at Credit Agricole Indosuez in New York prior to that and started his career at Salomon Smith Barney. Mr. Reilly has spoken on family office issues at many conferences and has been quoted in the Wall Street Journal, The Financial Times, Forbes, and Bloomberg, and currently does a monthly interview series with notables in the family office world for Family Wealth Report, where he is on the global editorial board.

Lisa Featherngill

National Director of Wealth Planning

Comerica Bank

Lisa leads a team of highly experienced and credentialed professionals who provide customized financial, business transition and wealth transfer planning advice. Lisa has advised UHNW individuals and multi-generational families for […]

Lisa leads a team of highly experienced and credentialed professionals who provide customized financial, business transition and wealth transfer planning advice. Lisa has advised UHNW individuals and multi-generational families for more than 30 years. She has been quoted in various media regarding tax and estate planning topics including Bloomberg TV, The New York Times and Wall Street Journal. Prior to joining Comerica, Lisa spent over 20 years at Wells Fargo and predecessor banks building and leading wealth planning groups, Lisa also spent 11 years at Arthur Andersen in Washington, D.C. She is a CPA (not practicing), Personal Financial Specialist (PFS) and a CFP® professional. As a member of the American Institute of CPAs, Lisa has served on several committees and is currently chair of the Advanced Estate Planning Conference committee.

Martha Pomerantz

Partner, Investment Portfolio Manager

Evercore Wealth Management

Martha is a partner and portfolio manager at Evercore Wealth Management and the manager of the firm’s Minneapolis office. She is a member of the firm’s strategic planning committee and […]

Martha is a partner and portfolio manager at Evercore Wealth Management and the manager of the firm’s Minneapolis office. She is a member of the firm’s strategic planning committee and the firm’s investment decision-making body, the Asset Allocation Committee.

Martha joined Evercore in 2011 with several partners to establish the firm’s Midwest office. She previously served as an investment principal and the co-chair of the Investment Committee at Lowry Hill, a wealth management firm in Minneapolis. She earlier worked as a securities analyst for Schroder Wertheim in New York.

Michael Cole

Managing Partner

R360

Michael is an industry veteran with more than 25 years of experience building successful wealth management firms. Most recently, Michael served as the CEO of Cresset Asset Management, an SEC […]

Michael is an industry veteran with more than 25 years of experience building successful wealth management firms. Most recently, Michael served as the CEO of Cresset Asset Management, an SEC Registered Investment Advisor. Cresset offers individuals and families access to a comprehensive suite of family office services, personalized wealth management, investment advisory, planning, access to third-party and direct private investments and advanced technology and reporting solutions. Before joining Cresset, Cole was founder and president of Ascent Private Capital Management of U.S. Bank, an award-winning multi-family office. Prior successes include head of Wells Fargo Family Wealth, now called Abbot Downing, and President of Merrill Lynch Trust.Cole is author of the book More Than Money: A Guide to Sustaining Wealth and Preserving the Family. Since its release, the book has consistently been in the top 100 of Amazon’s best-selling books in Wealth Management and Financial services.

Michael Wagner

Co-Founder and Chief Operating Officer

Omnia Family Wealth

Michael Wagner, CFP® is co-founder and chief operating officer at Omnia Family Wealth. In this position, Michael is responsible for the ongoing operational and business strategy of Omnia, as well […]

Michael Wagner, CFP® is co-founder and chief operating officer at Omnia Family Wealth. In this position, Michael is responsible for the ongoing operational and business strategy of Omnia, as well as ongoing analysis of each client family relationship and development of Omnia’s team. His responsibilities also include participating in the firm’s investment committee, where he assists in manager selection, analysis and risk management. Michael works closely with Omnia’s clientele and functions as the firm’s chief technology officer.

Michael is an avid photographer, and is also heavily involved with the Greater Miami Jewish Federation (GMJF), where he sits on the board of directors and several committees. He is currently serving as Co-chair of the Agency Support Committee, which builds and enhances Federation’s relationship with its key local agencies, manages the oversight of each agency, discusses communal trends, and identifies areas of concern. Michael resides in Fort Lauderdale.

Michael Zeuner

Managing Partner

WE Family Offices

Having joined WE Family Offices as one of its three managing partners in 2013, Michael Zeuner oversees the firm’s US business. A management consultant by training, Michael has considerable experience […]

Having joined WE Family Offices as one of its three managing partners in 2013, Michael Zeuner oversees the firm’s US business. A management consultant by training, Michael has considerable experience as a leader in the wealth management industry. This included a leadership position at GenSpring Family Offices, where he was a member of the firm’s operating committee and senior executive partner responsible for the firm’s local family offices across the US. Before this he was managing director and global head of wealth solutions at JP Morgan Private Bank, having been head of strategy and marketing worldwide at Chase Manhattan Private Bank prior to its merger with JP Morgan in 2002. Michael is also a board member and co-founder of the Institute for the Fiduciary Standard.

Mike Slemmer

LP Sales Director

Dynamo Software

Mike Slemmer is Sales Director at Dynamo Software. Dynamo powers investment decisions of clients representing $4tn+ of assets and serves over 1,000 clients including pension funds, sovereign wealth funds, endowments […]

Mike Slemmer is Sales Director at Dynamo Software. Dynamo powers investment decisions of clients representing $4tn+ of assets and serves over 1,000 clients including pension funds, sovereign wealth funds, endowments and foundations, family offices, funds of funds, private equity firms, M&A teams, venture capital groups, hedge funds, fund administrators, prime brokerages, and insurance firms. Previously, he was a senior consultant at The Collaborative. Mike has deep experience in investment technology, having had many sales, marketing and leadership roles at SS&C, Thomson Financial/ThomsonReuters, FundCount and Chase. Mike earned his BA from the University of Delaware, an MBA in finance from the University of Houston and an executive degree from the Columbia University Graduate Business School. He is a CFA (Chartered Financial Analyst) charter holder and a member of the CFA Institute and the CFA Boston.

Neil Nisker

Co-Founder, Executive Chairman and CIO

Our Family Office

Neil is a trusted and respected figure in the Canadian financial services industry. With 50 years of experience, Neil has served as President of Fiera Private Wealth, as the company’s […]

Neil is a trusted and respected figure in the Canadian financial services industry. With 50 years of experience, Neil has served as President of Fiera Private Wealth, as the company’s Executive Vice Chairman and a member of its Board of Directors. He was also President of YMG Private Wealth, Chairman of Nisker Associates and was a driving force behind Brown Baldwin Nisker Ltd for more than 25 years, before it was sold and became HSBC Securities in 1998. He is also well known for being one of three managers of Sir John Templeton’s personal global mutual fund, Best Investments International, having been selected by his mentor in 1990. Active in philanthropy, he’s acted as Co-Chair of the UJA Federation of Greater Toronto Annual Campaign, Co-Chair of the Baycrest Centre for Geriatric Care Campaign, Vice-Chair of Mount Sinai Hospital Foundation and Chair of its Investment Committee, Chair of the Jewish Foundation of Greater Toronto and Chair of its Investment Committee.

Patti Boyle

Chief Marketing Officer

Dstillery

Leading results-driven strategic planning for growth-focused organizations, Patti operates two distinct yet compatible consultancies. As Founder and President of Boyle Consulting Group, she applies her expertise in developing brand positioning, […]

Leading results-driven strategic planning for growth-focused organizations, Patti operates two distinct yet compatible consultancies. As Founder and President of Boyle Consulting Group, she applies her expertise in developing brand positioning, mission/vision/values and digital marketing to private equity-owned businesses, including those in WealthTech and FinTech. Following an early career in global marketing agencies, such as JWT and FCB, Patti led SEI Investments’ UK-based Marketing Team for Private Banking. Patti is also CEO of an early-stage venture, Sapience Leadership, affiliated with The University of Pennsylvania. In this role, Patti works with a team of inspiring educational leaders in the areas of Educational Equity, Diversity & Inclusion and Executive Coaching. Applying business principles and leadership experience to Education brings a unique balance to Patti’s work and has resulted in dynamic growth for both of her client communities. She has been active with the FWR Awards, since its inception in 2013.

Rebecca Meyer

Consultant

Relative Solutions

Rebecca guides family enterprises as they navigate the complexities of intergenerational ownership and planning for transitions. With the benefit of a systems perspective, she helps family enterprises address the need […]

Rebecca guides family enterprises as they navigate the complexities of intergenerational ownership and planning for transitions. With the benefit of a systems perspective, she helps family enterprises address the need for evolving governance while enhancing leadership and collaboration skills among family members. This work enables families to embrace the gifts and talents of all family members to help ensure a sustainable enterprise. A key part of her focus is preparing next generation family members to take on new roles. Prior to joining Relative Solutions, Rebecca spent over 15 years as a business leader working in and with family offices, advising families on governance, communication, and family learning. She also wrote a guidebook for social impact investors as part of the Center for High Impact Philanthropy at the University of Pennsylvania. Rebecca enjoys contributing to industry publications and speaking at conferences. Her focus is exploring practical approaches to helping enterprising families address the challenges that arise from sharing financial resources. Rebecca earned her BA from the University of Pennsylvania and her MBA from the University of Maryland. She trained at the Bowen Center for the Study of the Family in Washington, DC, is a 21/64 Certified Advisor, and a member of the Family Firm Institute (FFI).

Richard Chen

Managing Partner

Richard L. Chen PLLC

Richard Chen is the Founder of Richard L. Chen PLLC, a law firm that serves the investment advisory community. Richard advises on numerous compliance matters including compliance program development and […]

Richard Chen is the Founder of Richard L. Chen PLLC, a law firm that serves the investment advisory community. Richard advises on numerous compliance matters including compliance program development and implementation, mock audits, and SEC examinations. Richard also counsels investment advisers concerning business formation/structuring, contract drafting, mergers, employment matters, succession planning, private fund formation, and operational due diligence. Before launching his practice, Richard spent many years at several preeminent law firms in New York after graduating from Harvard Law School and Harvard College. Please visit his firm’s website and visit his LinkedIn page to learn more about him and his practice.

Ronna Gyllenhaal

Director of Strategic Marketing & Communications

The Family Office at Synovus

Ronna Gyllenhaal leads the strategic direction of The Family Office at Synovus’ marketing and communications initiatives. A highly skilled marketing and communications expert, Ronna has spent her career helping firms […]

Ronna Gyllenhaal leads the strategic direction of The Family Office at Synovus’ marketing and communications initiatives. A highly skilled marketing and communications expert, Ronna has spent her career helping firms advance corporate growth and innovation by remaining at the forefront of industry trends, technologies, and audience preferences. Her deep knowledge of the family office and wealth management industry and understanding of family dynamics bring a distinctive view into the world of family and wealth.

Rusdi Sumner

Vice President, Chief Operating Officer

Market Street Trust

Rusdi oversees a division of Client Services and leads both the Financial Planning Program and the Operations Team, working closely with all specialists to deliver full financial plans to clients. Prior […]

Rusdi oversees a division of Client Services and leads both the Financial Planning Program and the Operations Team, working closely with all specialists to deliver full financial plans to clients. Prior to joining Market Street, Sumner was Vice President and Managing Director of Tompkins Financial Advisors, while serving on the Tompkins Trust Company’s leadership team and as an Innovation Ambassador. Sumner received a B.A. from Cortland State University summa cum laude in Business Economics and Communications. She also holds a dual-degree MBA with distinction from Cornell University’s Samuel Curtis Johnson School of Management and the Smith School of Business, Queen’s University (Ontario, CA).

Steve Prostano

Partner, Head of Family Advisory Services

PKF O’Connor Davies

Steve is an innovator and thought leader in the global financial services industry. He has built leading MFOs and asset management firms and has advised industry leaders and UHNW families […]

Steve is an innovator and thought leader in the global financial services industry. He has built leading MFOs and asset management firms and has advised industry leaders and UHNW families and family offices for over 30 years. Prior to PKFOD, Steve was the Head of Family Wealth Advisors, the first global MFO in the U.S. and a division of Bank of the West | BNP Paribas, where he served on the Bank’s Senior Management Committee. He is also the founder of The UHNW Institute. Steve previously served as the CEO of Silver Bridge, President of Atlantic Trust, President of Chase Global Asset Management and he also held senior positions with Fleet, Mellon Bank, and KPMG.

Susan R Schoenfeld

CEO and Founder

Wealth Legacy Advisors

Susan R. Schoenfeld, JD, LL.M. (Taxation), CPA, MBA, is CEO and founder of Wealth Legacy Advisors LLC. She is an award-winning Thought Leader to families of wealth, and Public Speaker […]

Susan R. Schoenfeld, JD, LL.M. (Taxation), CPA, MBA, is CEO and founder of Wealth Legacy Advisors LLC. She is an award-winning Thought Leader to families of wealth, and Public Speaker to the financial services industry who serve them -- or want to! -- on the human issues that keep families of wealth up at night: Legacy, Next Generation, Stewardship, Governance, Leadership Succession, and Philanthropy. Based in NYC, she is a “recovering” Attorney and CPA, and “one of the few women on the national speaking circuit who is guiding financial services firms and their clients to connect with the human side of the client relationship.” - Family Wealth Report Awards 2020. Susan’s passion is helping families (and their provider organizations) with the tools to take them to their full potential. For more, visit

SusanSchoenfeld.com and WLALLC.com.

Susan Winer

Co-founder and Chief Operating Officer

Strategic Philanthropy

Susan is Principal and Co-founder of Strategic Philanthropy, Ltd. Since 2000, Strategic Philanthropy, Ltd., has provided customized support to high net worth individuals, families and closely held companies to help […]

Susan is Principal and Co-founder of Strategic Philanthropy, Ltd. Since 2000, Strategic Philanthropy, Ltd., has provided customized support to high net worth individuals, families and closely held companies to help them effectively maximize the impact of their charitable gifts. Susan has authored, or co-authored, numerous articles for publications such as Family Wealth Report, PAM (Private Asset Management), Alliance and STEP (Society of Trust and Estate Practitioners). She is Chair of the Social Impact and Philanthropy Domain for The Ultra High Net Worth Institute and on the Advisory Board for Family Wealth Report as well as a judge for the Family Wealth Report Awards.

Theresa Clarkson

Solutions Architect

InfoGrate

In her current role, Theresa oversees and manages the implementation of everything from workflows and SharePoint to accounting migrations. Prior to joining InfoGrate Wealth, she worked for Market Street where […]

In her current role, Theresa oversees and manages the implementation of everything from workflows and SharePoint to accounting migrations. Prior to joining InfoGrate Wealth, she worked for Market Street where her responsibilities focused on cyber-security, complying with New York State Department of Financial Services regulations, and strategic efficiencies through technological enhancements. Previously, Theresa worked for CRB Consulting Engineers as their Corporate Applications Manager, leading the support team for all major corporate applications, including accounting, intranet, secured client portals and website. Theresa holds a B.A. and M.S. from Elmira College in Information Technology Management, and is currently an adjunct instructor there teaching Information Technology in their business management program. She holds a Microsoft Certification in VB.net programming and an executive certification in negotiation through Notre Dame University.

Tom Burroughes

Group Editor

ClearView Financial Media

Tom Burroughes is group editor of ClearView Financial Media, publisher of WealthBriefing, WealthBriefingAsia and Family Wealth Report. Tom has worked at ClearView since 2008, reporting on news stories, interviewing industry […]

Tom Burroughes is group editor of ClearView Financial Media, publisher of WealthBriefing, WealthBriefingAsia and Family Wealth Report. Tom has worked at ClearView since 2008, reporting on news stories, interviewing industry leaders, writing features and comment pieces, and has spoken at conferences in London, Guernsey and Vienna, among other locations. He has discussed the industry’s issues on Reuters television and the BBC. Previously, Tom was wealth management editor of The Business, the weekly UK magazine run by the Telegraph Group, from 2007 to 2008. Before that, he was a correspondent in various roles at Reuters, the global newswire. Between 1994 and 2000, he was a reporter for Market News International, a New York-headquartered newswire.

Vikram Chugh

Chief Operating Officer

Robertson Stephens

Vikram Chugh oversees the wealth management platform at Robertson Stephens and is responsible for firm operations, advisor due-diligence and onboarding, technology, marketing and business strategy. Vikram has 20 years of leadership […]

Vikram Chugh oversees the wealth management platform at Robertson Stephens and is responsible for firm operations, advisor due-diligence and onboarding, technology, marketing and business strategy. Vikram has 20 years of leadership experience working at BlackRock, Merrill Lynch and Capital One. Most recently, Vikram led the business development effort for BlackRock’s Aladdin Wealth business in the Americas region. He was instrumental in the build out and launch of BlackRock’s Digital Wealth platform including the Aladdin Wealth capability, iRetire solution as well as the acquisition of FutureAdvisor. Vikram earned a BTech degree from Indian Institute of Technology (I.I.T.), Delhi and is a CFA® charterholder.

Wendy Spires

Head of Research

ClearView Financial Media

Wendy has been a wealth management journalist, researcher and consultant for a decade, covering a huge range of international markets and sub-sectors over that time. Known as a technology and […]

Wendy has been a wealth management journalist, researcher and consultant for a decade, covering a huge range of international markets and sub-sectors over that time. Known as a technology and communications specialist, she has written an array of in-depth reports on issues affecting private banks and wealth managers, ranging from compliance and innovation trends through to client experience, branding and marketing strategies. As well as speaking at conferences in both the UK and abroad, Wendy also regularly consults for wealth and asset managers, including carrying out research projects among end H/UHNW clients for both internal and external purposes.

William Trout

Director of the Securities and Investments

Datos Insights

William Trout serves as Director of the Securities and Investments practice at Datos Insights, focusing on technology strategy and innovation in the capital markets. He has particular expertise in platform […]

William Trout serves as Director of the Securities and Investments practice at Datos Insights, focusing on technology strategy and innovation in the capital markets. He has particular expertise in platform automation; data capture, storage and analytics; and portfolio management and optimization. Within the wealth and asset management arena, his interests include investment advisory and wholesaling and distribution services, as well as private banking and trust.

Will's research and consulting work is informed by more than more than two decades of industry experience. Prior to joining Datos Insights, Will led wealth and asset management in the U.S. and the U.K. at Celent, a division of Oliver Wyman, before launching separate advisor- and investor-focused research practices at Javelin Strategy & Research. Prior to those roles, Will spent many years in product and segment management at BBVA Compass, where he helped guide the introduction of a pioneering managed-accounts platform and the expansion of banking and investments services targeting high-net-worth and institutional investors.

An authority on digital advice delivery, Will has been widely quoted in the trade press as well as in publications such as the Financial Times and The Wall Street Journal. He is also a frequent speaker at industry conferences and gatherings. In his spare time, Will is an avid runner and reader of history.

Will holds a Bachelor of Arts from Harvard College.

Categories

Award Categories The Family Wealth Report Awards program is designed to award firms and individuals for their initiatives, efforts and success in their North American operations. A downloadable list of categories is now available here. Guidance for Entry Please find below some guidance on how to choose the correct categories to enter:- The list of categories consists of 12 Award Groupings which consist of a number of categories.

- The list provides a description per Awards Grouping and descriptions for each category.

- Each Award Grouping shows a "Who may enter" description.

- There is no limit on the number of submissions.

- Ensure the correct names of firms and individuals on the submission forms as we will be using these in any marketing activity for successful companies and individuals.

Sponsors Interviews

Finalists

9th Annual Family Wealth Report Awards 2022 Finalists

Family Office and Banking categories

| Ascent Bank of America Brown Advisory Burgher Haggard Caprock Carson Group CIBC Private Wealth Citi Private Bank Cresset Crestone Capital Delegate Advisors Destiny Family Office Evercore Fiduciary Trust Company | Fifth Third Bank Finemark Gresham Partners Hightower JDJ Family Office Services Kandor Global Advisors Kayne Anderson Rudnick Investment Management Key Family Wealth Keystone Global Partners New Republic Partners Northland Wealth Management Northwood Family Office Omnia Family Wealth Our Family Office | Pathstone Pennington Partners RBC Wealth Management Socius Family Office TAG Associates The Family Office at Synovus Tiedemann Advisors Tolleson Wealth Management Van Leeuwen & Company Verdence Capital Advisors Vogel Consulting WE Family Offices |

Investment & Asset Management and Responsible Investing categories

| 3Sisters Sustainable Management Anacapa Advisors AngelSpan (Legacy Funds) Arnerich Massena Ascent Bailard BNY Mellon Wealth Management Brown Advisory Capital Counsel Capital Dynamics | Capital Generation Partners CAZ Investments CIBC Private Wealth Citi Private Bank Copia Wealth Studios Cresset Envestnet Fiduciary Trust International Genus Capital Management Glenmede | New Republic Partners Our Family Office Pathstone RBC Wealth Management Sonen Capital StepStone Conversus T Rowe Price The Family Office at Synovus Tiedemann Advisors WE Family Offices |

Consultants, Private Client and Insurance categories

| Alliant Private Client Anchin Arnerich Massena Axiom Black Bag BNY Mellon Wealth Management Boston Private Brown & Brown Capital Generation Partners CIBC Private Wealth Citi Private Bank Cresset Dentons | Fiduciary Trust Company Fiduciary Trust International Fifth Third Bank Foundation Source Glenmede Gresham Partners Handler Thayer Lockton Private Risk Solutions Mack International Neal Gerber Eisenberg PKF O’Connor Davies PNC Private Bank Hawthorn PURE | Putnam Consulting Group PwC Tamarind The Family Office at Synovus The Targeted Strategies Group Tiedemann Advisors UBP IAS Vogel Consulting Walker Philanthropic Consulting Wells Fargo Willow Street |

Specialist Wealth Management categories

| Aspiriant Bank of America Bind these words Black Bag BlackCloak BNY Mellon Wealth Management | Citi Private Bank Concentric Copia Wealth Studios Hightower Intersect Capital JDJ Family Office Services Leafplanner | Marsh McLennan PCS Masttro PLUMB Red Point Labs Ronald Varney Summitas Tamarind |

Technology categories

| Adhesion Wealth Advent AdvicePeriod Advyzon Alkymi Altsmark Andes Wealth Technologies Aquilance Asset Vantage Backstop Solutions Bank of America Bill.com Black Diamond Wealth Platform Blender BNY Mellon Pershing BNY Mellon Wealth Management Canoe Intelligence Charles River Development | Citi Private Bank Copia Wealth Studios Datafaction Envestnet ETON Solutions Fifth Third Bank Finlight Fintree FIS FundCount InvestCloud Laserfiche Leafplanner Masttro Mirador Novus Partners Orion Advisor Solutions PKF O’Connor Davies | PLUMB Private Wealth Systems PwC RBC Wealth Management RedTail Technologies Sage Intacct SEI SS&C Salentica SS&C Technologies Summitas Tamarind The E-Valuator Vanilla Venn By Two Sigma Vestmark WealthHub Solutions Zenith |

Leadership and Women in Wealth categories

| AdvicePeriod Arnerich Massena Ascent Aspiriant Bailard Bank of America CAIS Capital Generation Partners Carson Group CIBC Private Wealth Citi Private Bank Dentons Envestnet Fiduciary Trust Company | Financial Freedom Glenmede Gresham Partners Handler Thayer Hightower Key Family Wealth LibertyFi Mack International Matson Money NEPC Northwood Family Office Optas Capital Pathstone Perth Leadership Institute | Pitcairn PKF O’Connor Davies PNC Private Bank Hawthorn PwC Risclarity Robertson Stephens SEI Tamarind The Family Office at Synovus The Inheritance Project Tolleson Wealth Management Truist Wealth Wealth Legacy Advisors Wells Fargo |

About our Sponsors

Technology Sponsors

ProFundCom helps financial institutions raise and preserve AuM using digital marketing analytics. ProFundCom has been built using expertise and best practice from within the financial services industry. Our marketing analytics focus solely on the asset/investment management space and offer an integrated solution across all digital properties. We understand email/web traffic patterns of investment management clients and how you can leverage these behaviours.

smartKYC’s AI software is used by banks to automate customer due diligence whether for remediation, onboarding, refresh or continuous monitoring; our technology drives faster, better, and more cost- effective KYC at every stage of the relationship – liberating human effort to focus on decision-making rather than laborious screening and research. smartKYC integrates all relevant KYC sources - external watchlists, media archives, open web search, private company data, internal blacklists and, like a human, it reads everything and extracts useful intelligence in the form of facts. smartKYC presents facts about risks like adverse media, but also provides insights into information like source of wealth, network risk and even ESG misdemeanours. Sophisticated hit scoring maximises relevance and minimises false positives. All of this is done at speed and at scale and, as such, straight through processing opportunities become obvious. In refresh or continuous monitoring mode, smartKYC watches only for net new risks as they emerge and never repeats what is already known.

Category Sponsors

Bray Executive Search (formerly RMG Associates) is the leading executive recruiting service for wealth management focusing on family clients of significant wealth. We are national recruiters working exclusively in UHNW/HNW family wealth advisory with offices in Seattle and Philadelphia.

Bray Executive Search is proud to have some of the industry’s most distinguished family wealth management firms as our clients and have had the privilege to advise some of the top talent in the industry on their career transitions.

Schwab Advisor Family Office

Our mission is to be the most trusted custodian to investment advisors and family office professionals serving the ultra-wealthy community. Our dedicated team of experts is highly specialized in providing what is most critical to the modern family office. As an industry leader, we combine high-touch service with the modern technology needed for today’s single- and multi-family offices. We also offer subject matter expertise, curated thought leadership, and bespoke events to fuel success and ensure sustainability of the family office firms we serve. It’s why 434 family offices custody with Schwab Advisor Services™ and why we are entrusted with $706 billion1 in ultra-high-net-worth household assets.

Schwab Asset Management®

As one of the industry’s largest and most experienced asset managers, Schwab Asset Management’s offering goes well beyond being a leading ETF provider and mutual fund provider. We serve the complex needs of family offices across the country through dedicated separately managed accounts in the areas of direct indexing and personalization, as well as specialized fixed income. We also work with families to curate liquidity management strategies designed for their unique needs, and offer a wealth of educational resources and expert insights to the UHNW community. By operating through clients’ eyes and putting them at the center of our decisions, we aim to deliver exceptional experiences to family offices, as well as the investment professionals who serve them.

Schwab Charitable™

Schwab Charitable is an independent 501(c)(3) public charity with a mission to increase charitable giving in the U.S. by providing a tax-smart and simple giving solution and philanthropic resources to donors and their investment advisors. Since our founding in 1999, Schwab Charitable donors have granted over $33 billion to more than 246,000 charities2. Visit SchwabCharitable.org for more information.

Disclosures

1 As of February 29, 2024

2 As of December 31, 2023

Schwab Advisor Services™ provides custody, trading, and the support services of Charles Schwab & Co., Inc. ("Schwab"), member SIPC, to independent investment advisors and Charles Schwab Investment Management, Inc. ("CSIM").

Schwab does not provide legal, regulatory, tax, or compliance advice. Consult professionals in these fields to address your specific circumstances.

Independent investment advisors are not owned by, affiliated with, or supervised by Schwab.

Schwab Charitable Fund™ is recognized as a tax-exempt public charity as described in Sections 501(c)(3), 509(a)(1), and 170(b)(1)(A)(vi) of the Internal Revenue Code. Contributions made to Schwab Charitable Fund™ are considered an irrevocable gift and are not refundable. Once contributed, Schwab Charitable has exclusive legal control over the contributed assets.

Schwab Charitable does not act as a trustee or custodian. Donors should consult their legal or tax advisor about their particular circumstances.

Schwab Charitable™ is the name used for the combined programs and services of Schwab Charitable Fund™, an independent nonprofit organization. Schwab Charitable Fund has entered into service agreements with certain subsidiaries of The Charles Schwab Corporation.

Schwab Asset Management® is the dba name for Charles Schwab Investment Management, Inc., the investment adviser for Schwab Funds, Schwab ETFs, and separately managed account strategies. Schwab Funds are distributed by Charles Schwab & Co., Inc. (Schwab), Member SIPC. Schwab ETFs are distributed by SEI Investments Distribution Co. (SIDCO). Schwab Asset Management and Schwab are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation, and are not affiliated with SIDCO.

©2024 Charles Schwab & Co., Inc. (“Schwab”). All rights reserved. Member SIPC.

(0524-VLYH)

InvestCloud is a global company specialising in digital platforms that enable the development of financial solutions, pre-integrated into the Cloud. The company offers on-demand client experiences and intuitive operations solutions using an ever-expanding library of modular apps, resulting in powerful products. Headquartered in Los Angeles, InvestCloud has over 20 global offices including New York, London, Geneva, Singapore and Sydney, supporting trillions in assets across hundreds of diverse clients – from the largest banks in the world to wealth managers, asset managers and asset services companies.

Venue

Mandarin Oriental

Address: 80 Columbus Circle at 60th Street, New York, New York 10023, USA

Winners

9th Family Wealth Report Awards 2022 Winners

Family Office categories

MULTI-FAMILY OFFICE (up to and including $2.5 billion AuM/AuA)

Highly commended: Socius Family Office

Winner:Our Family Office

MULTI-FAMILY OFFICE ($2.5 billion to $5 billion AuM/AuA)

Verdence Capital Advisors

MULTI-FAMILY OFFICE ($5 billion to $15 billion AuM/AuA)

Highly commended: Kayne Anderson Rudnick Investment Management

Winner: WE Family Offices

MULTI-FAMILY OFFICE ($15 billion AuM/AuA and above)

Pathstone

MULTI-FAMILY OFFICE (CLIENT INITIATIVE)

Ascent Private Capital Management®

MULTI-FAMILY OFFICE (NEW ENTRANT)

Kandor Global Advisors

OUTSTANDING CEO

The Family Office at Synovus - Katherine Dunlevie

OUTSTANDING CIO (CHIEF INVESTMENT OFFICER)

Gresham Partners - Ted Neild

RISING STAR UNDER 40

Highly commended: Pennington Partners - Brian Gaister

Winner: Socius Family Office - Kaylyn Melia

Banking categories

FAMILY OFFICE SOLUTION

Key Family Wealth

INTERNATIONAL PRIVATE BANK

Citi Private Bank

NATIONAL AND REGIONAL PRIVATE BANK

Bank of America Private Bank

Consultants to Private Clients

FAMILY OFFICE MANAGEMENT CONSULTANCY

PKF O’Connor Davies Family Office

FAMILY WEALTH COUNSELLING

Tamarind Partners, Inc.

PHILANTHROPY ADVICE

Highly commended: Walker Philanthropic Consulting

Winner: Putnam Consulting Group

SOLUTIONS FOR “INTERNATIONAL AMERICANS”

Citi Private Bank

Private Client Categories

ACCOUNTANCY ADVISOR

PKF O’Connor Davies Family Office

FIDUCIARY OR TRUST SERVICES

Willow Street

LEGAL TEAM OF THE YEAR

Dentons

TAX ADVISOR

Anchin Private Client

WEALTH PLANNING

Highly commended: Gresham Partners

Winner: Tiedemann Advisors

Investment and Asset Management Categories

ALTERNATIVE ASSET MANAGER

Citi Private Bank

ASSET MANAGEMENT FIRM SERVING FAMILY OFFICES AND PRIVATE BANKS

Brown Advisory

OUTSOURCED CIO

Pathstone

PRIVATE CLIENT INVESTMENT PLATFORM

CIBC Private Wealth

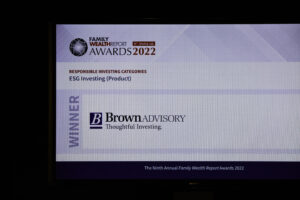

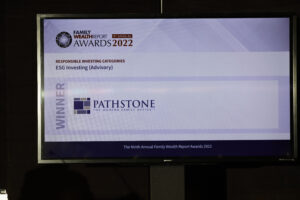

Responsible Investing Categories

ESG INVESTING (ADVISORY)

Pathstone

ESG INVESTING (PRODUCT)

Highly commended: Capital Dynamics

Winner: Brown Advisory

IMPACT INVESTING (ADVISORY)

highly commended: Arnerich Massena

Winner: Glenmede

IMPACT INVESTING (PRODUCT)

Genus Capital Management

Specialist Wealth Management Categories

ART & PRIVATE COLLECTIONS

Highly commended: Citi Private Bank

Winner: Ronald Varney Art Advisors

CONCIERGE/SPECIALIST SERVICE FIRM

Tamarind Learning, Inc.

CYBER SECURITY

BlackCloak

HEALTHCARE SERVICES

Black Bag

MARKETING OR PR CAMPAIGN

Marsh McLennan Agency Private Client Services

PROPERTY & HOUSEHOLD

JDJ Family Office Services

SECURITY CONSULTING & RISK MANAGEMENT

Concentric

Insurance Categories

INSURANCE BROKERAGE PROVIDER

Alliant Private Client

INSURANCE UNDERWRITER

PURE Insurance

Tech Categories (Inhouse and Advisors)

CLIENT DRIVEN INNOVATION (B2C)

Adhesion Wealth

CUSTOMER FACING DIGITAL PLATFORM

BNY Mellon Wealth Management

IMPLEMENTATION OF A TECHNOLOGY SOLUTION

Merrill Lynch Wealth Management (Bank of America)

Technology vendor categories

ACCOUNTING

FundCount

BILL PAY

Bill.com

COMPLIANCE

Highly commended: Alkymi

Winner: The E-Valuator

CLIENT COMMUNICATIONS (EXCL. REPORTING)

Black Diamond Wealth Platform

CONSOLIDATED REPORTING

Highly commended: Black Diamond Wealth Platform

Winner: Masttro

CRM SYSTEM

WealthHub Solutions

FINANCIAL RISK MANAGEMENT

Venn By Two Sigma

FINTECH START-UP

Altsmark

OUTSOURCING/BUSINESS PROCESS OUTSOURCING

Canoe Intelligence

ONBOARDING

Highly commended: Risclarity

Winner: Andes Wealth Technologies

PORTFOLIO MANAGEMENT

SEI Novus

PRODUCT INNOVATION (B2B)

Vanilla

Women in Wealth Categories

WOMEN IN WEALTH ADVISORY (INDIVIDUAL)

Bailard - Sonya Thadhani Mughal

WOMEN IN WEALTH BANKING (INDIVIDUAL)

Bank of America Private Bank - Katy Knox

WOMEN IN WEALTH FAMILY OFFICE (INDIVIDUAL)

Highly commended: Pitcairn - Amy Hart Clyne

Winner: Pathstone - Sue Peterson

WOMEN IN WEALTH INVESTMENT (INDIVIDUAL)

Citi Private Bank - Hale Behzadi

WOMEN IN WEALTH MANAGEMENT (COMPANY CONTRIBUTION)

Highly commended: Pitcairn

Winner: Glenmede

WOMEN IN WEALTH TECHNOLOGY (INDIVIDUAL)

Tolleson Wealth Management - Jennifer Wagoner Kirksey

Leadership Categories

DIVERSITY IN WEALTH MANAGEMENT (COMPANY)

Arnerich Massena

LEADING INDIVIDUAL (MFO)

CIBC Private Wealth - Eric B. Propper

LEADING INDIVIDUAL (SERVICE PRODUCT PROVIDER)

Mack International - Linda Mack

OUTSTANDING CONTRIBUTION TO WEALTH MANAGEMENT THOUGHT LEADERSHIP (COMPANY)

Dentons

OUTSTANDING CONTRIBUTION TO WEALTH MANAGEMENT THOUGHT LEADERSHIP (INDIVIDUAL)

PKF O’Connor Davies - Stephen Prostano

Lifetime Achievement

Joe Calabrese - Key Private Bank

Previous Winners

Congratulations to the winners and commended firms and individuals of the Family Wealth Report Awards 2021 program

Lifetime Achievement Award

Jamie McLaughlin

Banking categories

CREDIT SOLUTION

Winner Tolleson Wealth Management

Commended Citco Institutional Services

NATIONAL BANK

Winner First Republic

REGIONAL BANK

Winner Key Private Bank

Consultants to Private Client Categories

FAMILY OFFICE MANAGEMENT CONSULTANCY

Winner PKF O'Connor Davies Family Office

FAMILY WEALTH COUNSELLING

Winner Wells Fargo

Commended Hawthorn

SOLUTIONS FOR “INTERNATIONAL AMERICANS”

Winner Reyl Overseas

PHILANTHROPY ADVICE

Winner The Family Office at Synovus

Family Office Categories

MULTI-FAMILY OFFICE (up to and including $2.5 billion AuM/AuA)

Winner Delegate Advisors

Commended Keystone Global Partners

Commended Northland Wealth Management

MULTI-FAMILY OFFICE ($2.5 billion to $5 billion AuM/AuA)

Winner Burgher Haggard

MULTI-FAMILY OFFICE ($5 billion to $10 billion AuM/AuA)

Winner Tolleson Wealth Management

MULTI-FAMILY OFFICE ($10 billion to $15 billion AuM/AuA)

Winner WE Family Offices

MULTI-FAMILY OFFICE ($15 billion AuM/AuA and above)

Winner Tiedemann Advisors

MULTI-FAMILY OFFICE (new entrant)

Winner Our Family Office

MULTI-FAMILY OFFICE (client initiative)

Winner The Family Office at Synovus

Insurance Categories

INSURANCE BROKERAGE PROVIDER

Winner Alliant Private Client

INSURANCE UNDERWRITER

Winner PURE Insurance

Investment & Asset Management Categories

ALTERNATIVE ASSET MANAGER

Winner Citi Private Bank

ASSET MANAGEMENT FIRM SERVING Family Offices and Private Banks

Winner Brown Advisory

Commended Capital Counsel

OUTSOURCED CIO

Winner Glenmede

PRIVATE CLIENT INVESTMENT PLATFORM

Winner CIBC Private Wealth Management

Commended Bessemer Trust

RESPONSIBLE INVESTING/ESG/IMPACT INVESTING – Product

Winner Sonen Capital

RESPONSIBLE INVESTING/ESG/IMPACT INVESTING – Advisory

Winner Tiedemann Advisors

Leadership Categories (company)

DIVERSITY IN WEALTH MANAGEMENT

Winner BMO Family Office

OUTSTANDING CONTRIBUTION TO WEALTH MANAGEMENT THOUGHT LEADERSHIP

Winner Boston Private

WOMEN IN WEALTH MANAGEMENT

Winner Glenmede

Leadership Categories (individual)

LEADING INDIVIDUAL (MFO)

Winner Pathstone - Matthew Fleissig

Commended TAG Associates - Jonathan Bergman

LEADING INDIVIDUAL (Service product provider)

Winner Trusted Family - Edouard Thijssen

Commended Envestnet - Tony Leal

OUTSTANDING CONTRIBUTION TO WEALTH MANAGEMENT THOUGHT LEADERSHIP (Individual)

Winner James Grubman and Dennis Jaffe

WOMEN IN WEALTH MANAGEMENT (Individual)

Winner CIBC Private Wealth Management - Frances Boatwright

Private Client (Legal & Fiduciary) Categories

ACCOUNTANCY ADVISOR

Winner PKF O'Connor Davies Family Office

FIDUCIARY OR TRUST SERVICES

Winner Pitcairn

Commended Tolleson Wealth Management

LEGAL TEAM OF THE YEAR

Winner Neal Gerber Eisenberg

Commended Handler Thayer

TAX ADVISOR

Winner Anchin Block Anchin

WEALTH PLANNING

Winner Gresham Partners

Specialist Wealth Management Categories

ART & PRIVATE COLLECTIONS

Winner Ronald Varney Fine Art Advisors

Commended Citi Private Bank

CONCIERGE/SPECIALIST SERVICE FIRM

Winner Theia Senior Solutions

CYBER SECURITY

Winner Summitas

HEALTHCARE SERVICES

Winner Black Bag

MARKETING OR PR CAMPAIGN

Winner Fiduciary Trust Company

PRIVATE TRAVEL

Winner Integris

PROPERTY & HOUSEHOLD

Winner JDJ Family Office Services

Technology Categories (In-house & Advisors)

CUSTOMER FACING DIGITAL PLATFORM

Winner Advyzon

INNOVATIVE CLIENT SOLUTION

Winner RBC Wealth Management

Commended MaxMyInterest

IMPLEMENTATION OF A TECH SOLUTION/BEST TECH STACK

Winner Robertson Stephens

Technology Vendors

BILL PAY

Winner Bill.com

INNOVATIVE CLIENT SOLUTION

Winner Summitas

Commended DCS

Commended FIS Wealth & Retirement

COMPLIANCE

Winner Foreside

ACCOUNTING

Winner FundCount

CLIENT COMMUNICATIONS (EXCL. REPORTING)

Winner Summitas

Commended SS&C Black Diamond

CONSOLIDATED REPORTING

Winner Addepar

Commended InvestSuite

Commended Masttro

CRM SYSTEM

Winner WealthHub Solutions

ONBOARDING

Winner Canoe Intelligence

OUTSOURCING/BUSINESS PROCESS OUTSOURCING

Winner SEI

Commended PKF O'Connor Davies Family Office

Commended SS&C Advent

PORTFOLIO MANAGEMENT

Winner Solovis

Commended Charles River Development

Commended SS&C Black Diamond

Winners Interviews

Photographs

Frequently Asked Questions

Q) Do I/my firm need to be a member of the Family Wealth Report network?

A) Yes, this program is open to all Family Wealth Report members.

Q) How do I/my firm become a member of Family Wealth Report and what are the benefits of being a member?

A) Sign up here or contact theodora.viney@clearviewpublishing.com or adriana.zalucka@clearviewpublishing.com

Q) Is there any upfront cost to enter?

A) No, there is no upfront cost to enter, but you will be offered to acquire a winner’s package should you be successful. This includes the option of tickets to attend the gala dinner.

Q) Is the process open to firms that are not active within the North America region?

A) The judges will only consider submissions from firms that are active in the region. Please see here an overview of our global awards programmes.

Q) How do you ensure that the judging process is independent and impartial?

A) We have five judging teams responsible for judging a number of categories. The judging will be a two-stage process. First, the judges will each review and score the submissions . Then, they will discuss the overall scores within their judging teams.

Q) Can you assure me that any details that I submit will be treated with confidentiality.

A) We collect your details and only share submissions with the judges’ team responsible for judging those particular categories. We ensure that there is no conflict of interest with the judges’ team before sharing entrants’ details. All our judges have signed a Non-Disclosure Agreement.

Q) My submission is likely to be longer than the 750-word max limit. Would this disadvantage me?