Awards

The Third Annual WealthBriefingAsia External Asset Management Awards 2024

Thursday - 3rd October 2024

Mandarin Oriental, Singapore

5 Raffles Avenue Marina Square, Singapore 039797

Overview

WealthBriefingAsia is excited to announce the launch of the third awards program highlighting the importance of External Asset Managers to the wealth management industry in Asia.

The nomination process for the WealthBriefingAsia External Asset Management Awards 2024 is now open culminating in a celebratory gala dinner at The Mandarin Oriental, Singapore on the 3rd October 2024. A preview of what to expect on the evening can be seen here.

The categories for entry are focused around these main areas:

- Pan-Asia Categories

- International Categories

- Regionally-Based Categories

- Specialist Pan-Asia Categories (Team/Offering)

- Technology (both in-house and external)

- Other Pan-Asia Categories

- Pan-Asia Leadership Based Categories (Individual)

As is the case for all our global awards programs, independence, integrity, and genuine insight will be the watchwords of the judging process, which as always will be conducted by expert panels drawn from both custodian banks and trusted advisors/consultants to the sector.

Having reported on the wealth management industry for nearly 20 years and being responsible for several research reports specifically covering this area, we are best placed to initiate a process that fairly rewards achievement, top class performance and innovation.

Winning a WealthBriefingAsia Award sets organisations and individuals apart from their peers and is a tangible demonstration that they have something special to offer.

We very much look forward to you joining the process and to welcoming you to celebrate your achievement at the awards presentation in October 2024.

Sponsorship Opportunities

For further information on sponsorship opportunities please contact rachel.fokes@clearviewpublishing.com

Further Information

For more information about the awards and submission process please contact siiri.piiroinen@clearviewpublishing.com

Key Dates

Public announcement of winning entries and Awards presentation – 3 October 2024

Venue

Mandarin Oriental, Singapore

Address: 5 Raffles Avenue Marina Square, Singapore 039797

Frequently Asked Questions

Q) Does the entering firm or individual need to be a subscriber to WealthBriefingAsia?

A) No, this program is open to all firms and individuals active in wealth management or the family office sectors.

Q) Can my firm enter more than one category?

A) Yes, we encourage firms to enter as many awards that are applicable to their business.

Q) Do I need to use the submission form provided?

A) Yes, submissions shall only be accepted when using this document.

Q) Is there any upfront cost to enter?

A) No, there is no upfront cost to enter, but you will be offered the chance to purchase a winner’s marketing package should you be successful. The judging process is completely independent of the commercial arrangements between the participants and the organisers. However it is expected that when the results are made public, winners will engage with the organisers to promote their win and also attend the awards ceremony to accept their trophy.

Q) Is the process open to firms that are not currently active within the Asia region?

A) The judges will only consider submissions from firms that are demonstrably active in the region. Please see here an overview of our global awards programmes.

Q) How do you ensure that the judging process is independent and impartial?

A) The Judges are independent of the award organisers ensuring they are divided into separate panels to avoid conflicts of interest.

Q) Can you assure me that any details that I submit will be treated with confidentiality.

A) We only share submissions with the panel responsible for judging those particular categories. Furthermore, our experienced team ensures that there is no conflict of interest before they share an entrant’s submission with anyone. All our judges have signed a Non-Disclosure Agreement.

Q) My submission is likely to be longer than the 1,000-word max limit. Would this disadvantage me?

A) We have set the limit out of respect to the judges and we are keen to maintain this to ensure that there is a level playing field between competing submissions. Judges reserve the right to refuse to review submissions that do not comply. We also encourage against attachments to the submissions.

Q) Do I need to submit a separate submission for each category?

A) You will need to do a new form for each submission and you should also ensure that this specifically relates to the category for which you are entering. If you are using the same answers for multiple submissions this could result in your entry being marked down by the judging panel.

Q) Where is the winner’s announcement shared?

A) The winners are announced publicly the day after the official awards celebration and this is via our editorial and social media platforms.

Q) Can I speak to anyone on the team about my entry?

A) Yes, our experienced team is always available to assist you with preparation of your submission/s and any aspects of the process from start to finish. For any questions please contact siiri.piiroinen@clearviewpublishing.com

Judges

WealthBriefing’s global awards program is built on the independence of our judges.

The judges for WealthBriefingAsia’s External Asset Management Awards 2024 are being invited from partners in the custodian banks, technology companies and other service providers. Each judge will have signed an NDA to ensure that all the information they receive in the submissions is kept in the strictest confidence. Further judges will be advised in due course

Trusted Advisors

Dr. Mario A. Bassi

Senior Advisor

Private Wealth Management

Mario brings extensive experience to the industry as senior advisor driving sales and business initiatives in Asia Pacific for UHNWI/FO service providers. He draws upon his detailed understanding from roles such as global head of business management for ANZ Private Bank in Australasia, where he defined and delivered the strategic and operational needs for the business.

Previously Mario worked for leading wealth managers such as Vontobel, Credit Suisse and Deutsche Bank, holding positions across a variety of disciplines including relationship management, business and financial planning, training and development, strategy, business development and marketing communications in both Europe and Asia. He was also managing director for Solution Providers Management Consulting, leading its growth in Asia Pacific, specifically Singapore.

He wrote and published his Ph.D. thesis about the supervision of External Asset Managers [EAM] in Switzerland (“Der bankunabhängige Vermögensverwalter: Analyse des Handlungsbedarfs einer möglichen Aufsicht unter Berücksichtigung des amerikanischen und englischen Rechts”), build up/out of various EAM desks in Switzerland and Singapore and serviced this segment.

Patrick Busse

Head GFIM Singapore

UBS AG

Patrick joined UBS in October 2022 as Co Head FIM APAC after 12 years with Credit Suisse Group across the locations Zurich and Singapore. He has served in investment advisory and relationship management functions. Patrick has over ten years of experience with independent asset managers in Asia and is responsible for UBS FIM Singapore. He combines extensive knowledge in the areas of asset and relationship management as well as building successful teams. He has a passion for developing technologies that help clients achieve optimal results. He holds a Bachelor in Business Administration and a Master in Banking and Finance from the University of St. Gallen.

Sean Chee

Deputy Team Head of the SEA Intermediaries Team

Julius Baer

Sean Chee is a seasoned professional in the financial industry, currently serving as the Deputy Team Head of the SEA Intermediaries team at Julius Baer. With a wealth of experience as a Private Banker and Portfolio Manager, Sean has previously held positions at reputable institutions such as Credit Suisse and Citibank. His background as a Portfolio Manager at Covenant Capital further solidifies his expertise in managing portfolios and investments. Sean’s extensive experience and leadership in the financial sector makes him a valuable asset to the Intermediaries team in Julius Baer.

Shiladitya Choudhuri

Market Head - EAM & Multi-Family Office Business

Indosuez Wealth Management

Shiladitya Choudhuri is Market Head for External Asset Management & Multi-Family Office at Indosuez Wealth Management in Singapore. He is responsible for the commercial strategy, and market and risk management for the External Asset Management (EAM) business. A veteran of the bank, Shiladitya also serves as the Market Head for the NRI (Non-Resident Indians) business. After a successful stint in HSBC Private Bank, Shiladitya joined Indosuez in 2009 and was promoted to Managing Director in 2014.

Shiladitya has held numerous senior roles across three decades managing clients and businesses in private banking, wealth management, retail banking and start-ups in Asia, the Middle East and

India. Through these experiences, he has gained a deep understanding of his network of global clients, their cross-generational investment needs, and matters of succession planning.

Shiladitya was an integral part of ICICI Bank’s initial retail expansion in India in 1999, and its international

venture into Dubai in 2001. In 2004, he played a pivotal role in launching ABN Amro Bank’s NRI business in

Singapore.

Shiladitya holds a Bachelor’s degree in Statistics and a Master in Business Management from the University

of Calcutta, India. In 2015, he completed the Advanced Management Programme at INSEAD in Fontainebleau,

France.

Emmanuel Guillaume

Head of External Asset Managers, Asia-Pacific

Lombard Odier

Emmanuel Guillaume is Head of External Asset Managers, Asia-Pacific for Lombard Odier. Emmanuel is responsible for leading Lombard Odier’s intermediary business in Asia-Pacific (APAC), overseeing a team of

professionals committed to delivering best-in-class private banking services and innovative solutions for intermediaries in APAC.

Residing in Singapore since 2002, Emmanuel has extensive experience in advisory and sales roles covering external asset managers in Singapore and Hong Kong. Before joining Lombard Odier, he was Head of Structured

Solutions & Investments Asia at Vontobel. Prior to this, he was Head of Investments at Citibank and Head of Structured products Asia at UBP.

Emmanuel has significant expertise in bespoke investment solutions. He graduated from EM Lyon Business School, and also holds a Master’s degree from Université Paris Dauphine-PSL.

Markus Haeny

Co Head FIM APAC

UBS AG

Markus is Co Head FIM APAC, responsible for the team in Hong Kong since 2023. Markus has over 20 years of experience at UBS Global Asset Management and UBS Wealth Management. Over the past 17 years, he has served financial intermediaries and end clients in APAC in various roles: first as a member of the Capital Market Advisory team and then as FIM Client Advisor and Business Developer. In 2018, he was appointed Head FIM Singapore and Co Head FIM APAC in 2021. Markus holds a Master of Advanced Studies in Finance from the University of Bern and a Master of Science in Wealth Management from the University of Rochester, New York.

Regina Ho

Coordinator for their Education & Research Committee

Family Office Association Hong Kong

Regina has worked in private wealth management for the last 19 years, holding various product roles in trading, structuring and treasury. She held the executive role overseeing the wind down of Coutts & Co Asian business interests. She has extensive experience in sales, product management and trading platforms and is also well versed in dealing with banking regulations and platform development.

Regina currently serves the Family Office Association Hong Kong as a Coordinator for their Education & Research Committee, promoting the family office community and events.. Regina holds a Master’s Degree in Law from the Chinese University of Hong Kong.

Michel Hofstetter

Head of Intermediaries Singapore

VP Bank

Michel Hofstetter assumes the role as the Head of Intermediaries at the Singapore branch of VP Bank. An industry veteran with more than two decades of experience in the banking industry working with intermediaries, Michel joined VP Bank Ltd Singapore Branch in 2022 and is currently responsible for growing the Bank's intermediaries business and increasing share of wallet in the market.

Before VP Bank, Michel was in Julius Baer as Deputy Head of Intermediaries Southeast Asia and covered various intermediary roles in global banking hubs such as Zurich, New York and Singapore.

Anne Liebgott

Founder

AW●ASIA PACIFIC | MIDDLE EAST

Anne is founder of the online platform AW●ASIA PACIFIC | MIDDLE EAST at americanswelcome.asia

Matthias Real

Senior Relationship Manager EAM

Banque Internationale à Luxembourg (Suisse) SA

Matthias has started his journey in the Private Banking space in the late 1990ies in Switzerland. During his career, he has worked in both Los Angeles (2 years) as well as Singapore (7 years). Prior to joining BIL Suisse in 2023, he worked for 2 years for one of the two fully regulated Crypto Banks in Switzerland. In his new role with BIL Suisse, he also oversees the Asia based intermediaries’ business out of Switzerland.

Shrikant Tawari

Partner - Clients & Markets

Valuefy

Born in Jaipur and raised near Delhi, Shrikant holds a Bachelor of Arts in Economics and an MBA with a focus on finance and marketing. His career began with a significant tenure at Thomson Reuters, where he gained valuable insights into global financial markets, which later informed his work at Valuefy.

Outside of his professional life, Shrikant enjoys a balanced personal life with his wife and their 10-year-old son. His hobbies include playing cricket, football, badminton, and he has recently taken up golf. Committed to mental well-being, Shrikant has also completed a 10-day meditation retreat, underscoring the importance he places on mindfulness and balance.

Gary Tiernan

CEO

Various

Gary Tiernan has worked in the international finance industry for over three decades. He now runs his own consulting business supporting UHNWIs and families. He is an experienced CEO and CIO in the MFO and EAM areas.

He started his career in investment banking, holding management roles in London and Switzerland. In private banking, he has held several global roles, and multiple senior regional roles in Asia and Europe, and worked extensively with clients internationally. These roles have covered investments, fiduciary and wealth planning, and sales management.

Bruce Weatherill

Chief Executive

Weatherill Consulting

Bruce is a chartered accountant with over 37 years financial services experience, previously a partner in PwC, latterly as Global leader of their Wealth Management practice and the key driver of their bi-annual Wealth Management Report. Bruce is now CEO of Weatherill Consulting providing advice on client centricity and wider strategic matters to wealth managers. He is the author of The Value of Trust: the quest by Wealth Managers for Trusted Advisor status and a number of other thought leadership reports. Bruce is chairman of ClearView Financial Media and a non-executive of a number of companies including Fidelity Holdings UK, The Wisdom Council, ComPeer, JDX Consulting and Ten Group.

David Wilson

APAC Wealth Management Lead

Accenture

David Wilson leads Accenture’s Asia Wealth Management practice, working with the senior leadership teams of the region’s wealth management firms to enable business growth and improve organizational enablement and efficiency. Previously, David was a team lead within UOB’s Group Strategy & Transformation function leading key Board- and Executive Committee-level strategy and digital transformation programs. Prior to UOB he spent over a decade in consulting and wealth management with Capgemini, Merrill Lynch, and UBS.

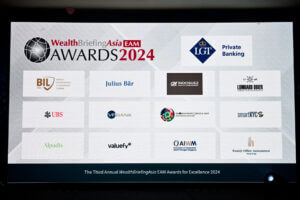

About our Sponsors

Diamond Sponsor

Category Sponsors

ProFundCom helps financial institutions raise and preserve AuM using digital marketing analytics. ProFundCom has been built using expertise and best practice from within the financial services industry. Our marketing analytics focus solely on the asset/investment management space and offer an integrated solution across all digital properties. We understand email/web traffic patterns of investment management clients and how you can leverage these behaviours.

smartKYC’s AI software is used by banks to automate customer due diligence whether for remediation, onboarding, refresh or continuous monitoring; our technology drives faster, better, and more cost- effective KYC at every stage of the relationship – liberating human effort to focus on decision-making rather than laborious screening and research. smartKYC integrates all relevant KYC sources - external watchlists, media archives, open web search, private company data, internal blacklists and, like a human, it reads everything and extracts useful intelligence in the form of facts. smartKYC presents facts about risks like adverse media, but also provides insights into information like source of wealth, network risk and even ESG misdemeanours. Sophisticated hit scoring maximises relevance and minimises false positives. All of this is done at speed and at scale and, as such, straight through processing opportunities become obvious. In refresh or continuous monitoring mode, smartKYC watches only for net new risks as they emerge and never repeats what is already known.

Custodian Sponsors

Trust Sponsor

Technology Sponsor

Supporting Association Partners

Sponsors Videos

Sponsor

Banque Internationale à Luxembourg (BIL)

Winners

Overall Pan-Asia Categories (Company)

Assets Between US$ 500 Million – US$ 1 Billion AuM

Mindful Wealth

Assets Between US$ 1 Billion and US$ 5 Billion AuM

Lumen Capital Investors Pte Ltd

Overall Pan-Asia External Asset Manager (Company)

Azimut Investment Management

International Categories (Company)

Servicing Mainland China Based Clients

Fargo Wealth Group

Best EAM in Hong Kong

Annum Capital

Servicing Japanese Clients

TriLake Partners

Servicing European Clients

TriLake Partners

Servicing Taiwanese Clients

Efinity Capital

Servicing Clients From Singapore

Wealth Management Alliance Pte Ltd

Regional Categories (Company)

Best EAM in Hong Kong – Regional

Blackhorn Wealth Management Limited

Based in Singapore

Eightstone Pte. Ltd.

Specialist Pan-Asia Categories (Team)

Legal/Trust

Farro Capital

Investment Advice

Lumen Capital Investors Pte Ltd

Best Portfolio Management in Asia

Crossinvest (Asia)

Wealth Planning

Sunline Wealth Management

Philanthropy Offering

AlTi Tiedemann Global

Fund Selection/Asset Allocation Programme

Taurus Wealth Advisors Pte. Ltd.

Next-Gen Programme

Farro Capital

Family Office Proposition

Wealth Management Alliance Pte Ltd

Thematic Investment Proposition or Strategy

Sunline Wealth Management

Digital Assets Advice or Proposition

SingAlliance Pte Ltd

Pan-Asia External Technology Solution Provider Categories (Company)

Client Lifecycle Management (External)

EasyView

Portfolio Management Solution (External)

Valuefy

Overall Pan-Asia Technology Solution Provider (External)

EasyView

Pan-Asia In-House Technology Categories (Company)

Client Reporting (In-house)

Efinity Capital

Innovative Use of Technology (In-house)

Fargo Wealth Group

Overall Digital Engagement (In-house)

Fargo Wealth Group

Other Pan-Asia Categories (Company)

Diversity Programme

TriLake Partners

Growth Strategy

Efinity Capital

Overall Pan-Asia Client Service

Farro Capital

Pan-Asia Leadership-Based Categories (Individual)

Chief Executive Officer (CEO)

Kenneth Kent Ho – Carret Private Capital Limited

Female Executive

Anthonia HUI – AlTi Tiedemann Global

Thought Leadership

Hrishikesh Unni – Taurus Wealth Advisors Pte. Ltd.

Rising Star Under 40

Jackson Ng – Azimut Investment Management

Leading Individual

Regan Shum – Annum Capital

Previous Winners

Overall Pan-Asia Categories (Company)

Assets Between US$ 1 Billion and US$ 5 Billion AuM

SingAlliance Pte Ltd

Overall Pan-Asia External Asset Manager (Company)

Azimut Investment Management

International Categories (Company)

Servicing Mainland China Based Clients

Fargo Wealth Group

Servicing Japanese Clients

TriLake Partners

Servicing European Clients

TriLake Partners

Servicing Taiwanese Clients

Efinity Capital

Servicing Clients From Singapore

Crossinvest (Asia) Pte Ltd

Servicing Clients From Australia

Crossinvest (Asia) Pte Ltd

Regional Categories (Company)

Based in Hong Kong

SystematicEdge Limited

Based in Singapore

Eightstone Pte Ltd

Specialist Pan-Asia Categories (Team)

Legal/Trust

Farro Capital

Portfolio Management

Sunline Wealth Management

Wealth Planning

Sunline Wealth Management

Philanthropy Offering

Farro Capital

Succession/Legacy Planning Advisory Service or Proposition

Farro Capital

Family Office Proposition

Wealth Management Alliance Pte Ltd

Thematic Investment Proposition or Strategy

Sunline Wealth Management

Digital Assets Advice or Proposition

SingAlliance Pte Ltd

Investment Advice Sanctum Wealth Private Limited

Pan-Asia External Technology Solution Provider Categories (Company)

Client Accounting (External)

HATCHER PLUS PTE. LTD.

Compliance Solution (External)

HATCHER PLUS PTE. LTD.

Overall Pan-Asia Technology Solution Provider (External)

EasyView

Pan-Asia In-House Technology Categories (Company)

Client Reporting (In-house)

Efinity Capital

Client Communications (In-house)

Alpha Capital

Innovative Use of Technology (In-house)

Fargo Wealth Group

Overall Digital Engagement (In-house)

Fargo Wealth Group

Other Pan-Asia Categories (Company)

Diversity Programme

TriLake Partners

Overall Pan-Asia Client Service

Alpha Capital

Growth Strategy

Futu Trustee Limited

Newcomer

WRISE Group

Pan-Asia Leadership-Based Categories (Individual)

Chief Executive Officer (CEO)

Azimut Investment Management – Andrea Ciaccio

Female Executive

Taurus Wealth Advisors Pte Ltd – Hema Mathur

Rising Star Under 40

St James’s Place Wealth Management – Jasmine Jalif

Categories

The submission process for the Third Annual WealthBriefingAsia EAM Awards 2024 is now unfortunately closed. For any questions, please contact siiri.piiroinen@clearviewpublishing.com