The Virtual Family Office FinTech Summit 2020 sessions have been recorded and are now available to watch (press on the images to play). If you are interested in replaying the technology demonstrations, or would like to request access to the event app, contact adriana.zalucka@clearviewpublishing.com and/or theodora.viney@clearviewpublishing.com. If you have already requested this, we’ll email you in due course. To visit the event website, click here.

FinTech and Family Office – A Strategic Imperative

In discussion with Tom Burroughes, Family Wealth Report’s group editor, Logan Allin, Managing General Partner at Fin VC, shares the latest trends in investing in Venture Capital, FinTech and the best practices global family offices employ, as well as the effects he is seeing so far of Covid 19. Allin gives a rare insight into the providers that help solve the number one technology-related pain point for family offices: aggregated performance reporting.

Exploring Bitcoin

Elisabeth Préfontaine, a senior wealth management figure and founder of Octonomics, an independent consultancy, talks to Tom Burroughes. They focus on the technology of Bitcoin, how it influences our financial world, and how people think about money and banking, especially post Covid 19.

The Man Who Solved The Market

Gregory Zuckerman, special writer at the Wall Street Journal, award winning journalist and author of three best-selling books discusses The Man Who Solved The Markets: How Jim Simons Launched the Quant Revolution. Talking to Gregory is Joe Reilly, family office consultant in investment and strategy, regular contributor and editorial board member of Family Wealth Report.

Generic Tools = Few Gains: Why Alternatives Investors Need Purpose Built Technology

Seth Brotman, CEO of Canoe Intelligence in conversation with Wendy Spires, Head of Research at Family Wealth Report

Towards The Frictionless Family Office

As financial and lifestyle management hubs, family offices orchestrate a huge array of moving parts. Connecting then coordinating all the people, processes and systems involved all too often relies on manual workarounds – with all the frustrations and risks that implies. New technologies are making truly frictionless family offices increasingly achievable, however, eliminating inefficiencies previously held to be par for the course.

New frontiers of risk: cybersecurity, privacy, and managing your digital exhaust

The possibilities of new technologies are endless, but there are risks to be alert for too. Many family offices are making big decisions about technology right now and so our opening panel will tackle some of the biggest hotspots of concern today: cybersecurity, cloud and the hidden risks of an increasingly connected ecosystem.

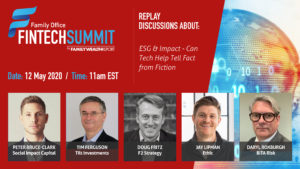

ESG & Impact – Can Tech Help Tell Fact from Fiction

Experts predict that impact investments could reach $1 trillion over the next decade, but this emerging asset class presents abundant challenges, ranging from investment selection and due diligence through to reporting and analysis. With marketing spin and “greenwashing” already becoming issues, family offices’ need for reliable, meaningful assessments of positive impact has never been greater.